Contents

When all the three moving averages coincide at a point then, it gives a strong signal that the market is either moving in upside direction or in downside direction. This strategy is known as 3 moving average crossover or golden cross strategy. It is based on moving average of different time frames.

Since markets are consolidating nearly 70 percent of the time, trend following trading strategy results in a number of whipsaws. Nearly 70 percent of the time will be wasted in trying to locate your friend. A trader’s patience is tested in trying to locate a market or a stock which is ready to move. We will be combining the Aroon with a moving average crossover in our strategy. For example, adding the closing prices of a security for the previous month and then dividing the total by the number of days in the month. A simple Moving Average is the average market price of a security over a specified period.

The average is a simple and effective indicator that showcase the price trends. However, it is challenging to indicate smaller price movements, but it will deliver considerable market indications if it’s difference between ceo and owner combined with a long-term moving average. If you analyze the Aroon formulae, you will note that there is only one parameter, time period. So this indicator gives you trend and momentum in terms of time.

So a 10 day moving average with take data of 10 current days and a 50 days moving average will take the data of 50 latest days. During a trend, a simple moving average may help to identify levels of support and resistance. For example, security in a long-term uptrend may fall marginally but find support at the 200-day simple moving average. Thus, the 200-day simple moving average serves as a support level and can help identify a change in trend.

Swing traders could enter at such crossover by selling shares with the expectation that the short-term trend has turned bearish and prices will fall. Ultimately the price did fall from Rs 2040 to Rs 1880 levels. Whenever a short-term moving average crosses over a long-term moving average, we call it a golden crossover and take it as a bullish sign to enter the market on the buy side.

For longer-term EMAs, the use of 50, 100, and 200 periods EMAs are more common and favored by traders. For example, to calculate a 9% exponential moving average of stock, we should multiply today’s closing price by 9%. Then, add this to the moving average of yesterday by 91% (100-9). Secondly, the points of resistance and support that lie along the 50-day line are often respected by the daily trades. The 50-day moving average is a dividing line that shows the stocks’ technical health on the upper line and not technically healthy on the lower line.

In this AFL the triple moving average buy, sell signals are coded and comes with Scanning and Exploration functionality. As discussed earlier, the exponential moving average can help us to identify trends. An upward slope of the EMA line indicates a bullish trend and a downward slope of the EMA line indicates a bearish trend. Coupled with price crossovers of EMA lines we can identify trends effectively. If the ribbons run parallel to price, that indicates a strong trend. The period of moving averages calculation depends upon the time frame of the chart and which moving average we are using.

- Secondly, the points of resistance and support that lie along the 50-day line are often respected by the daily trades.

- You may use it for free, but reuse of this code in a publication is governed by House Rules.

- To gain additional strength in the indicators, traders use this 50-day moving average along with a 200-day moving average to test the bullishness of a particular stock.

- Investment in securities market are subject to market risks, read all the related documents carefully before investing.

- If the market remains without clear direction for a longer period, algorithmic trading based on moving averages can be devastating to the investment.

- But when they are right they ensure that they make enough not only to repay the losses of the 60 percent trades but also have enough in the bank to have a comfortable life style.

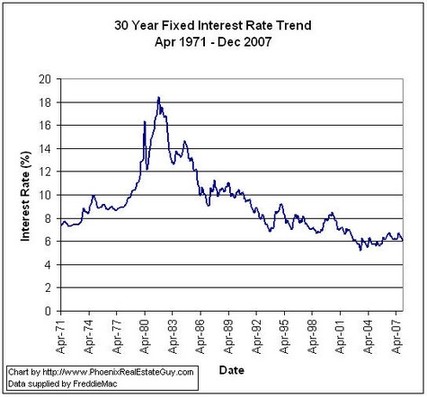

The trading system would result in loss if a total of 25 best trades out of 907 are missed in a period of 5 years. This demonstrates the fat tail distribution effect of trading returns. The Profit to loss ratio for the SMA period of 2 is 1.29.

Global Investment

Shown below is a live chart and application of EMA on RSI and volume. We commonly use the EMA line on these to get the trend of volume and RSI. The result of exponential the moving average is slightly different. For a 10-period EMA, 18% weight is given to the most recent price points making the EMA very close to the nearest price averages.

In those cases, for calculations of EMA for the first time, we use the simple moving average of previous n periods. But traders always prefer working with time periods instead of percentages. The percentage https://1investing.in/ can be converted to time periods EMA, and a 9% EMA can be converted to 21.2-day EMA or 21-day EMA. Moving Averages are also good to identify the support and resistance levels of the price.

Stages of A Golden Cross

Exponential Moving Average gives more weightage to the recent prices than the previous prices while calculating the average price. It gives more importance to the current price and less importance to older price data which better picture of the current trend. Therefore traders and analysts give more preference to the Exponential Moving Average. Its calculation method or formula is slightly tricky but we don’t have to calculate these, the trading platform software will automatically calculate and put it on the chart.

This trading pattern is used by traders to identify the short term market trend. Golden Cross moving average crosses above the 200-day moving average. This means that the recent average price is higher than the longer-term average price, which is often interpreted as a bullish signal indicating the progression of an uptrend. A bullish crossover occurs when the shorter moving average crosses above the longer moving average. A typical textbook-style golden and dead cross crossover can be done by using 50 days and 200-days moving averages.

Moving Average Crossover Strategy

It is referred to as the ‘moving’ average since it is plotted on a chart bar by bar and forms a line that moves along the chart as the average price changes. The longest losing streaks in each period are shown in Fig.9. A marked increase in losing streaks from these values would give an early warning that the markets have entered a period of different dynamics than the one in this simulation. The highest of eight losing trades in a row has occurred for the fast indicators . The effect of few strong moves is further illustrated in Fig.8. It shows the evolution of account balance in index points for the cases of missing the top few best trades in the SMA 2 system.

Consult your financial advisor before or do your own research before investing and trading. The short-term moving average is used to get a buy or sell signal. The point worth remembering in trading a trend following strategy is that even the best traders in the world are right only 40 percent of the time.

The slope of the line shows us the price change patterns visually. To gain additional strength in the indicators, traders use this 50-day moving average along with a 200-day moving average to test the bullishness of a particular stock. To calculate a 200-day moving average, a trader will need the closing prices for the 200 days to add and divide them by 200.

Nifty Critical Levels in View, Expert’s Advice to Investors & Street Outlook

The simple moving average is calculated by adding the price of a security over a period and then dividing that figure by the number of periods. Technical indicator is a statistical way of understanding the market. Technical indicator uses market data such as price, volume and open interest to arrive at the trend of the market. In this section we will be learning one of the most commonly used technical indicators – Moving average. The total net returns for the SMA period of 2 is the highest.

Technical analysis is based on the assumption that the future price of a stock can be predicted from its history. Several technical trading systems exist for generating buy and sell signals in stock prices. Simple moving average crossovers are popular tools for trading. In this study, simple moving average crossovers with different periods are analyzed empirically on historical daily data of NIFTY 50 index. The profit and loss distribution in these trades are studied to identify profitable and stable crossover periods.

The goal of the study is to identify best time periods for high profits as well as consistent profitability. The psychological aspects of the trading system is also examined with special emphasis on the rare profitable price movements that are crucial in technical trading. At a very basic level, traders and analysts employ technical tools such as simple moving averages to analyze market sentiment. Simple Moving Average is primarily applied for trend analysis and for identifying support and resistance levels.

To get a longer view of the price movement, a trader can add more days or periods and the closing prices. This moving average focuses more on the recent price movement and hence it is considered as more responsive towards than a simple moving average. The calculation for this is not as simple as the calculation for simple moving average .

The above rationale suggests one should buy Marico on dip for higher targets of Rs 460. A bearish crossover occurs when the shorter moving average crosses below the longer moving average. Now you will be able to see the triple moving average crossover with buy and sell indicators. An easy way to learn everything about stocks, investments, and trading. Bullish crossovers occur when a moving average crossover creates a bullish trading signal.