Contents

The best overlap is the London/New York active hours (1300hrs GMT – 1600hrs GMT). The foreign exchange market, or forex, is a global decentralized market. Optimal times to trade the forex market are when the market is most active, which is often when the trading hours of major regions overlap. Because of limited trading activity in the extended hours, the difference, or spread, between available buy and sell orders is likely to be greater than during standard market hours.

Liquidity refers to the ability of market participants to buy and sell securities. Generally, the more orders that are available in a market, the greater the liquidity. There may be lower liquidity during extended hours as compared to regular market hours.

New York/North American Session

The exchange is founded and managed by a corporation, private or public. It allows companies to list their stocks in its marketplace. American investors can buy and sell stocks listed on most foreign exchanges through a broker. Binary.com is an award-winning online trading provider that helps its clients to trade on financial markets through binary options and CFDs.

A big news release has the power to enhance a normally slow trading period. When a major announcement is made regarding economic data—especially when it goes against the predicted forecast—currency can lose or gain value within a matter of seconds. The U.S./London markets overlap (8 a.m. to noon EST) has the heaviest volume of trading and is best for trading opportunities. Yarilet Perez is an experienced multimedia journalist and fact-checker with a Master of Science in Journalism. She has worked in multiple cities covering breaking news, politics, education, and more.

Forex trading is the trading of different currencies to make money on changes in currencies’ values relative to one another. Most of this trading occurs via electronic platforms or over the phone rather than on exchanges. Overnight positions refer to open trades that have not been liquidated by the end of the normal trading day and are often found in currency markets. Forex market hours refers to the specified period of time when participants are able to transact in the foreign exchange market. Even though dozens of economic releases happen each weekday in all time zones and affect all currencies, a trader does not need to be aware of all of them. It is important to prioritize news releases between those that need to be watched versus those that should be monitored.

The above content provided and paid for by Public and is for general informational purposes only. It is not intended to constitute investment advice or any other kind of professional advice and should not be relied upon as such. Before taking action based on any such information, we encourage you to consult with the appropriate professionals. We do not endorse any third parties referenced within the article. Market and economic views are subject to change without notice and may be untimely when presented here. Do not infer or assume that any securities, sectors or markets described in this article were or will be profitable.

Award winning security of funds

Liquidity refers to how easy it is to quickly buy or sell securities for a fair price. If there is high liquidity the bid/ask spread will be tighter and you can trade more without moving the market. On the other hand, in an illiquid market the spread between the bid and ask may be very wide and not very deep.

The USD is the cue provider during the New York session, and traders can trade all the major pairs such as EURUSD, GBPUSD, USDCHF, USDJPY, USDCAD, AUDUSD, and NZDUSD. The US Federal Reserve is the central bank to watch, as well as major US data such as Nonfarm Payrolls, Trade Balance, GDP, Industrial Production, and Retail Sales. The forex trading sessions are named after major financial centers and are loosely based on the local “work day” of traders working in those cities. It’s important to note that, unlike stock market hours, cryptocurrency trades all day every day, making it somewhat riskier due to changes that can occur even when you sleep. Since there isn’t any downtime, those who invest in cryptocurrency should have a planning strategy to guide them.

24 hour trading isn’t just for derivatives traders anymore, the same functionality is now available on some of our most widely-traded securities. Applies to U.S. exchange-listed stocks, ETFs, and options. A $6.95 commission applies to trades of over-the-counter stocks, which includes stocks not listed on a U.S. exchange. « Previous Close » represents the closing price of the most recent standard session from the primary market on which the security trades.

Regular market hours overlap with your busiest hours of the day. Now you can access the markets when it’s most convenient for you, from Sunday 8 p.m. Competition—Many Stock Trading Vs Forex Trading extended hours traders are professionals with large institutions, and may have access to more current information than individual investors.

Daylight Savings Time

Of retail investor accounts lose money when trading CFDs with this provider. Please be advised that in the event of decreased liquidity or extreme volatility in the market, easyMarkets may switch trading to “Close only” or disable all trading. A stock exchange is a marketplace or infrastructure that facilitates equity trading.

- The issuers of these securities may be an affiliate of Public, and Public may earn fees when you purchase or sell Alternative Assets.

- Authorised and regulated by Cyprus Securities and Exchange Commission in the Republic of Cyprus at 19 Diagorou Str.

- Access Trading Hours, Market Holidays, Non-Settlement Dates, and more.

- Let’s take a more in-depth look at each of the sessions, as well as those periods when the sessions overlap.

- Foreign markets—such as Asian or European markets—can influence prices on U.S. markets.

The exchange trades two hours ahead of the NYSE, so much of the action follows that of the NYSE. The London Stock Exchange has a two-minute break at noon daily. For example, AUD/JPY will experience a higher trading volume when both Sydney and Tokyo sessions are open.

An alternative for investors in foreign stocks is to trade American depositary receipts , which trade on U.S. exchanges and in U.S. dollars. For an American investor, access to any of the international markets and exchanges requires an account with a brokerage, online or off. Naturally, these are the busiest times during the trading day because there is more volume when two markets are open at the same time. It’s important to remember that the forex market’s opening hours will change in March, April, October, and November, as countries move to daylight savings on different days. Actual open and close times are based on local business hours, with most business hours starting somewhere between 7-9 AM local time. We introduce people to the world of trading currencies, both fiat and crypto, through our non-drowsy educational content and tools.

Please note that while we endeavour to keep our information up to date some store trading hours may vary. Please call individual businesses to confirm before making plans. These securities were selected to provide access to a wide range of sectors.

The LME recognises 19 June 2024 and 19 June 2030 as US holidays, however as both dates are 3rd Wednesday prompts, these will remain as tradeable prompts until further updates are made by the LME. Whether you are an industrial hedger, physical market trader or prop desk there are, broadly speaking, two ways of accessing our markets. Trading 212 Markets Ltd. is authorised and regulated by the Cyprus Securities and Exchange Commission (License number 398/21).

The Sydney/Tokyo markets overlap (2 a.m. to 4 a.m.) is not as volatile as the U.S./London overlap, but it still offers opportunities. She has 20+ years of experience covering personal finance, wealth management, and business news. Krugerrands are South African gold coins that were minted in 1967 and remain popular among gold investors today. Both publish annual calendars of their holidays and half days. In 2022, the NYSE has 10 full holidays and four early-closing days.

When Does the Market Open for International Stocks?

Despite the fact that the NASDAQ trading floor doesn’t actually exist, the answer to the question, “what time does the stock market open? ” is still answered by the opening bell, even though there isn’t actually a bell that rings there. The term is used to signify the beginning of the trading day. Although Wall Street in New York City is the heartbeat of investing in the United States, it’s important to note that global stock exchanges work in the same way.

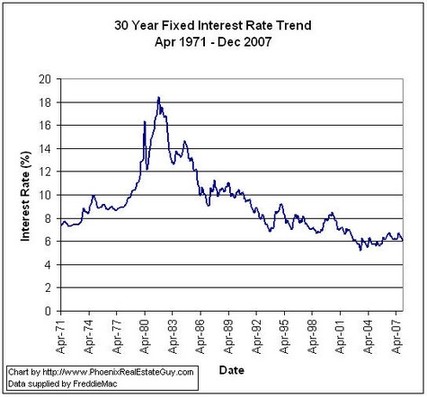

Forex Trading Volume

Please note that the commissions for trades executed in multiple sessions (i.e. Pre-Market, standard or After Hours) are not aggregated. Extended hours trades will normally settle two business days from the date the order is executed, just like orders placed during standard market hours. Forex markets are « open 24/7 » in a sense because different exchanges around the world trade in exactly the same currency pairs. While there are foreign stocks listen in the U.S. as ADRs, for example, the ADR shares will remain closed at certain hours when the actual foreign shares are open, and vice-versa. The London session opens at 0800hrs GMT, just as the Tokyo session closes.

You need to know when the forex market opens and closes as well as the four main trading sessions. Here’s what you need to know about stock market hours, and how the time of day can impact your trades. Good-for-Day limit orders placed with an instruction to execute during regular market hours will expire at the close of regular market hours forex trading vs stock trading that day. Good-for-Day limit orders placed with an instruction to execute during extended hours will expire at the end of the last extended-hours session that day. We will keep this information up-to-date as much as possible. Please be advised that in times of public holiday, there may be periods of limited liquidity in some markets.

DeSenne made the leap to online financial journalism in 1998, just in time for the dot-com boom. After a stint with Dow Jones Newswires, dreams of IPO riches led him to SmartMoney.com, where over nine years he held several positions, including executive editor. He later served as the personal dukascopy bank sa review finance editor at HouseLogic.com and AARP.org. In 2011, he joined Kiplinger.com, where he focuses on content strategy, video, SEO and Web analytics. DeSenne has a BA from Williams College in Anthropology—a major deemed the absolute worst for career success by none other than Kiplinger.

Head over to our Trading Academy to learn everything you need to know about the financial markets. Liquidity—Lower trading activity may result in a lower likelihood of your order being executed. In addition, there may be a number of orders ahead of yours that Xcritical Overview will be filled by incoming matching orders before your order can be filled. It is possible that your order will not be executed at all, or only partially executed. Unexecuted orders will be canceled at the end of the particular Extended Hours Trading session.

Once logged in, you’ll find Forex working at any time, except Saturday and Sunday, when all markets in all countries are closed. Likewise, Forex doesn’t work on holidays, for example, Christmas, New Year, and Easter. The forex market is open 24 hours a day during weekdays, but this does not necessarily mean that you should trade forex assets at any time, or all day. Volatility varies during different times of the day because of different forex trading sessions. To establish the best times to trade as well as the best forex assets to trade, it is important to understand the different forex trading sessions. Commissions and Trade Settlement—Commissions for extended hours trading are based on Schwab’s standard fee and commission schedule.